how to avoid inheritance tax in florida

Funds in a retirement plan. Learn more today from our experienced attorneys.

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

. Pennsylvanias Inheritance Tax is levied on assets passing to beneficiaries when a person passes away. Fortunately there is an exemption called the Unified Credit which lessens the blow for most estates. April 28 2022.

4 Take out life insurance. The PA inheritance tax rate is 15 for property passed to other heirs excluding charities and organizations that are exempt from PA inheritance tax Data Source. Life insurance policy proceeds.

Most assets devised through a will inheritance process will not result in tax liability. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. 3 Leave money to charity.

Read customer reviews find best sellers. One sure way to evade inheritance and inheritance taxes is to consider making a gift while still alive whether directly or even in trust with no holding on to any strings that will result in inheritance taxes. How do you avoid inheritance tax.

The Federal government imposes an estate tax which begins at a whopping 40this would wipe out much of the inheritance. The only other way that inheritance can result in taxation in Florida is when it counts as income. Property with right of survivorship.

The good news is Florida does not have a separate state inheritance tax. 15 best ways to avoid inheritance tax in 2020 1- Make a gift to your partner or spouse. It means that every year you can gift away up to 48000-worth of your estate without any adverse side effects.

Jointly owned property or real estate. Can you avoid inheritance tax. The 20000 is not taxable income to you.

Class D rates range from 15-16 and there is no inheritance tax for Class E. The PA inheritance tax rate is 12 for property passed to siblings. 13 Spend spend spend.

Fortunately these taxes are almost a thing of the past. For Class C the first 25000 is exempt and the rate on excess amounts starts at 11 and increases to 16. Put assets into a trust If you place assets within a trust they will not form part of your estate on death and avoid inheritance tax.

Children and grandchildren are taxed at 4 12 while brothers and sisters pay 12 and others including friends nieces and nephews pay 15. Understanding Inheritance Tax in Florida is essential to properly plan your estate. How much can you inherit in the USA tax Free.

Ad From Fisher Investments 40 years managing money and helping thousands of families. File for your Florida EIN How to Apply for a Tax ID in Florida. Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count as income for Federal income tax purposes and Florida does not have a separate income tax.

12 Give away assets that are free from Capital Gains Tax. You could place assets into a trust for the benefit of your children when they reach the age of 18 for example. Spouses can double their effort and reduce their estate by at least 96000 per year in this case.

Joint Tenants With Rights of Survivorship Two people may own real estate or personal property as joint tenants with rights of survivorship or JTWROS. For instance mom leaves you 20000 in life insurance. And any other assets moved to florida and titled appropriately to avoid any claims from your previous state.

The PA inheritance tax rate is 45 for property passed to direct descendants and lineal heirs. To the extent its assets exceed the 1118 million exemption as of 2018 an estate is taxed at a marginal rate of up to 40. The rate of tax varies depending upon who inherits the assets.

Payments made for education and medical treatment are also not considered taxable even if they exceed the 16000 exemption bar. Browse discover thousands of brands. 5 Avoid inheritance tax on property.

The inheritance itself is not income. The federal exclusion amount of 5 million opens up the possibility of making gifts to people or trusts. 2 Give money to family members and friends.

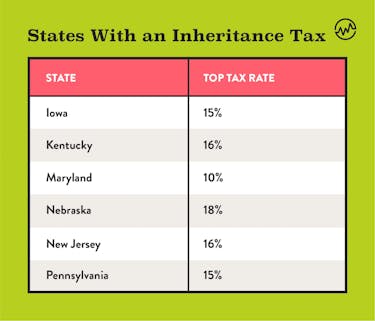

Property held in trust. For instance the inheritance tax rate is as much as 18 in Nebraska so a beneficiary might owe the government 18000 if they inherited a 100000 account. Funds in a pension plan.

Class A beneficiaries are not subject to any inheritance tax. How to Avoid Probate in Florida In Florida a person can avoid probate by using joint ownership with rights of survivorship beneficiary accounts lady bird deeds and living trusts. Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax.

You should roll over or move any retirement accounts such as Keogh plans 401. Funds in 401 k accounts with a named beneficiary. While the estate may earn income during the settlement timeframe the receipt of the inheritance is not taxed to a beneficiary.

Assets that can avoid probate typically include. Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. Only a handful of states still collect an inheritance tax.

As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance tax.

20 Funeral Planning Checklist Template Simple Template Design

How To Set Up A Trust In Wisconsin

How Loopholes Help Trump And Other Real Estate Moguls Avoid Taxes Published 2019 Real Estate Investing Commercial Real Estate Real Estate Investor

Waiting On Tax Refund What Return Being Processed Status Really Means Gobankingrates

Don T Get Sued 5 Tips To Protect Your Small Business Business Liability Insurance Business Insurance Small Business Insurance

Women Owned Business Tax Benefits Refer To The Tax Benefits A Female Entrepreneur Can Receive When Operating A Small In 2022 Business Tax Llc Taxes Sole Proprietorship

/images/2021/08/10/happy-woman-doing-taxes.jpg)

How To Avoid Inheritance Tax 8 Different Strategies Financebuzz

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Lady Bird Deed Has Benefits And Limitations Zolton Law Lady Bird Lady Benefit

What Is A Trust Fund How It Works Types How To Set One Up Estate Planning Checklist How To Plan Trust Fund

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Title Insurance Fort Myers Title Insurance Homeowners Insurance Insurance Marketing

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Estate Planning Estate Planning Estate Planning Checklist How To Plan

Estate Planning Estate Planning Estate Planning Checklist How To Plan

Pin On Newsrust Com World News Portal

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit